How proof of future revenue performance secured TDS' buy-out

And increased company valuation by 33%

TDS provides workplace security solutions to high-profile global leaders like Google, LinkedIn, Mastercard, Accenture and the UK Houses of Parliament.

When selling TDS the CEO, senior board and leadership teams needed to demonstrate future revenue projections. Their use of Planr enabled them to provide this and more with a level of accuracy that had never been seen before.

The Goal

Founded in 1990 by CEO Frank Hart, Time Data Security (TDS) is on an accelerated growth trajectory with ambitions to become the top provider of smart workplace solutions for enterprise businesses.

Frank and TDS’s senior board member Sean Murphy recently led TDS’ acquisition by Acre, a US-based global leader in state-of-the-art security systems.

We spoke to Sean about the steps that were key to the successful buyout.

The Challenge

“We have fantastic people in TDS. They are our greatest asset. When it came to communicating the value of the business, we needed to demonstrate the future performance of our teams and translate it into accurate revenue forecasts.

To prepare a company for sale there is a list of components to be considered – the most important is the future performance. This is the most valuable but also the most difficult to capture accurately. So when preparing for valuation it is critical that future revenue figures are real and can be proven and delivered upon.”

Selling TDS With Planr

“Typically this process involves collating data from across departments, many hours and spreadsheets, and the end result would be difficult to interrogate and validate.

It is almost impossible to have a disciplined approach. In this case we would have needed 2/3 accountants from across the business with multiple spreadsheets pulling graphs across departments from Sales, Marketing, HR, Finance, etc.”

What Planr Produced For TDS

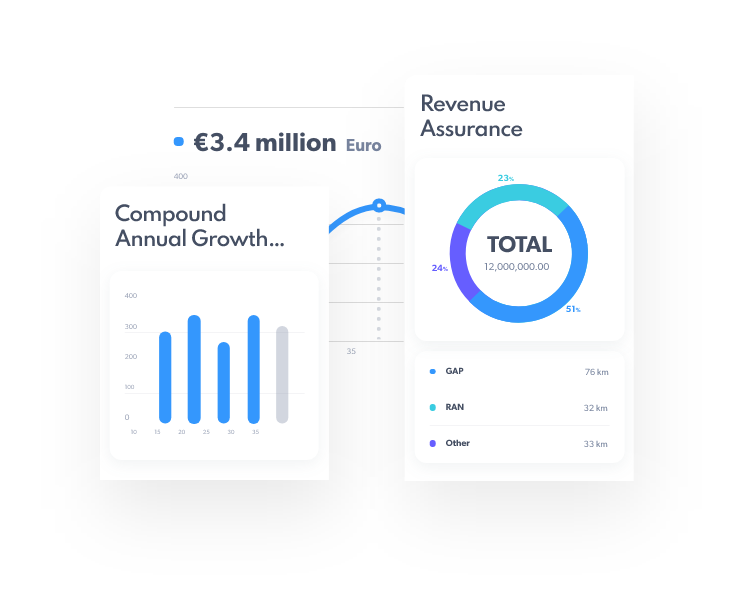

“Planr played a key role when TDS was being sold. It used advanced logic as well as sales components like ARR, Non-RR, Previous Revenue Performance, New Sales and Sales Capacity vs. Values Next Year to accurately project future revenue and EBITDA.

As part of the deal we showed the revenue forecast from both the top down and bottom up, demonstrated it in multiple visual formats and supported all interrogations and queries from the buyers. A clear, accurate and concise view of sales pipeline is critical for every business and with Planr we could show that. The longest report needed was just 5 slides.

Planr gave us everything we needed to convince the buyers that TDS could deliver the projected future revenue and currently we are on track to do that."

"Planr enables the board and I to focus and it moves the conversation from Finance to Revenue – that is where it should be for a high-growth company. I’ve always loved to have the confidence at board meetings that Planr gives us."

Planr In The Day-to-Day

“Prior to Planr, I found one of the biggest reporting challenges was accessing simple reports that could accurately reflect the position of the business. Others were happy with the reporting that was in place but I wasn’t because these reports were always questioned and we were getting stuck in the granularity of the data – that is not where a senior leadership team should be spending their time.

Companies can be too busy on the operational side. The Finance department typically own the area of revenue growth and assurance so businesses feel it is covered, however the link between finance and sales is often not articulated with the visibility or accuracy that’s required to deliver predictable revenue growth.

Planr educates Finance and leadership teams on the business performance and what’s behind the figures. This enables them to move past the numbers and use insights to make high-impact decisions.”

TDS' Top 5 Wins with Planr

Revenue is critical to any business today. We learned a lot about revenue analysis during the deal and Planr managed a huge amount of scrutiny. The Revenue Assurance Number is unique to Planr and it gave the buyers confidence in TDS’ future performance. Planr results are real, scientific and credible.”

We had certain systems in TDS but they were owned by each department, creating siloed views and increasing the chances that we would miss something key to our growth and performance.

If you are sitting on a board or are a stakeholder with a financial or strategic focus then you need a tool like Planr to help you keep an eye on the business instead of becoming lost in the detail. Oftentimes people are focusing on the wrong information and rearranging deck chairs rather than accessing the right predictions and taking impactful decisions.

Private Equity firms can value your business on either current or future performance. Future performance is preferable, however it’s the hardest to demonstrate. To build trust in the data, you have to show mature data processes and a sophisticated level of financial grip.

Our buyers were impressed by the level of sophistication we could demonstrate, how accessible accurate data was when they had a request or needed to interrogate, and how well the data stood up to scrutiny as part of the validation process.

This gave them assurance of future performance without any need for massive manipulation or additional spend on data science resourcing.

It’s critical to the valuation that future figures are real and can be interrogated, proven and delivered upon. Planr’s depth of data, logic and visualisation capabilities gave us this.

It can be very difficult to get a simple view of revenue. In most businesses the multitude of existing systems, processes and people involved creates complexity, and complexity leaves you open to error. Planr handles massive complexity but it is hidden from me as a user. Software should be simple and user friendly and that’s what Planr has achieved.